Most people are likely aware that so many small businesses have struggled in 2020. But have you talked with them (if you aren't one of them)? Do you understand how they were (or continue to be) impacted? What about those who lost all? I would like to share our journey not because it is easy to talk about, but in hopes that it might educate and inspire change in 2021 and beyond.This series wasn't easy to write or share, but it feels so necessary. We must all understand the reality of this situation to immediately put a stop to it. And more importantly, to never allow it to happen again in our great nation.

This is the first in a three-part series. Sign-up to receive each new entrepreneurial-themed blog post delivered conveniently to your inbox when they arrive!

DISCLAIMER: This is a real-life example of one family-owned small-business in the service sector in Oregon, USA. The details shared here are to help educate the public and provide an inside look to those who may be far removed from these realities.

How did our business start out in 2020?

We had long ago survived the initial hurdles in the start-up years. "Only 78.5% of small businesses survive their first year" and we were well past that point with eight years in full-time practice.

Our hard work and success had resulted in over 1,300 clients for one practitioner. To give perspective on this volume in terms of day to day customers, before 2020 an average return customer appointment waitlist was about a month for their next appointment. New patients usually had to wait closer to two months to get their first appointment. So there was high and consistent demand for services.

Knowing we had become well established, we had weathered the ups and downs, and we had learned how to strategize between high and low seasons, what could there be to fear?

Unforeseen Circumstances

As 2020 was unfolding we had frequent conversations with people about the situation we were up against as small business owners. A comment we heard was how 'annoying' or 'inconvenient' it must have been during the shutdowns, as though they had been some loosely defined recommendations. I found myself correcting them to clarify that our business was made illegal by the Governor of our State as a non-essential business by the end of March.

As 2020 was unfolding we had frequent conversations with people about the situation we were up against as small business owners. A comment we heard was how 'annoying' or 'inconvenient' it must have been during the shutdowns, as though they had been some loosely defined recommendations. I found myself correcting them to clarify that our business was made illegal by the Governor of our State as a non-essential business by the end of March. This could hardly be viewed as a slowdown in business, or a seasonal occurrence we could prepare ourselves for. So how did it get to that point?

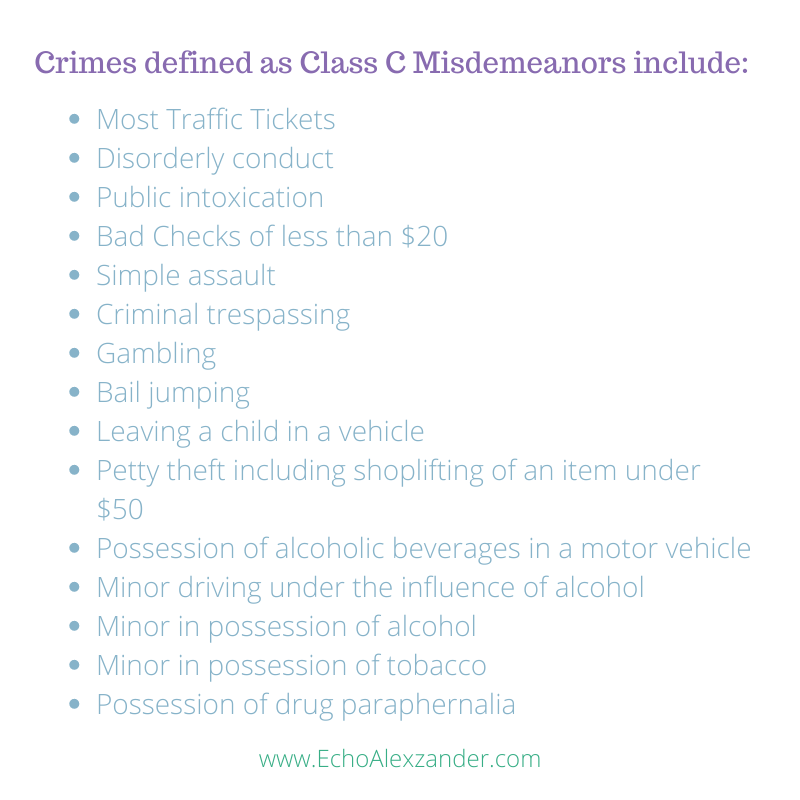

Executive Order No. 20-12 effective March 24th, 2020 our business was among a list that the Oregon Governor prohibited under penalty of Class C misdemeanor if found in violation and convicted.

How could we now be at risk to face jail time if found in violation of what was, as of yesterday, operating our business to provide for our family?

Wait, what?!? A Class C Misdemeanor?

“Under Oregon law, a Class C misdemeanor is punishable by up to 30 days in jail, a fine of up to $1,250, or both.”

So surely there must be a plan for all of those impacted by this government action, right?

How can an Emergency be Indefinite?

At the time this was issued the Oregon EO 20-12 was indefinite until terminated. There was no cutsie ‘two-weeks to hold on tight’ catch-phrase offered by the Governor to businesses to help them know how to react (not that it apparently helped any Oregonians since the two-weeks is looking to stretch a year).

This was with no end in sight. You have lost your ability to legally earn a living while still being financially liable for all your prior expenses. How does a business prepare themselves financially or psychologically to be made illegal to operate a mere 20 days after the declaration of a State-level emergency? And for a potentially indefinite period of time.

This was with no end in sight. You have lost your ability to legally earn a living while still being financially liable for all your prior expenses. How does a business prepare themselves financially or psychologically to be made illegal to operate a mere 20 days after the declaration of a State-level emergency? And for a potentially indefinite period of time. Where is this in business risk planning scenarios or modeling exercises in school? I have a business degree and can assure you that this wasn't on the menu. When did a service sector business think, 'someday, it might be a crime in my state to have close personal contact with other humans', and if it does, how will I "pivot" to online in order to succeed like other sectors? This EO 20-12 impacted 42 total sub-industries by name in our state, think how many businesses those entire industries represented?

It ended up lasting just under 68 days in total. For 68 days, due to no fault of our own, our business was simply not allowed by our state government to legally operate. Two months and one week we waited. We paid all of our bills, so those we owed didn't feel any impact, at least not from our business. And we received no outside support, we simply watched our savings drain away.

But there were government bailouts coming, weren't there?

Surely There Was State Funding!

There was a period where independent contractors were able to apply for unemployment (which my husband qualified as) under the PUA, but due to the brokenness of the Oregon Employment Department system, it was badly delayed (it began in August after the impact in March), and very little paid out in comparison to what my husband both qualified and applied for. It lasted four weeks and paid him $1,352 in total when all was said and done.

Our example business overhead in a four-week period run closer to $3,200 not including payroll or retirement contributions. Don’t forget any, examples of these expenses for a business include things like: office supplies, medical insurance premiums, power, internet, software, email, credit card processing, and website fees, business insurance, rent, sewer, city water, natural gas, bottled water service, payroll tax (yes, even when you have $0 payroll period there is still tax and filing fees due, not including the bookkeeping and CPA expenses) and legal services.

What about all those other alphabet acronym funding sources the news was always talking about?

Our example business overhead in a four-week period run closer to $3,200 not including payroll or retirement contributions. Don’t forget any, examples of these expenses for a business include things like: office supplies, medical insurance premiums, power, internet, software, email, credit card processing, and website fees, business insurance, rent, sewer, city water, natural gas, bottled water service, payroll tax (yes, even when you have $0 payroll period there is still tax and filing fees due, not including the bookkeeping and CPA expenses) and legal services.

What about all those other alphabet acronym funding sources the news was always talking about?

What About All of Those Other Support Programs?

PPP - This was not applicable to our particular situation/business so we were unable to apply.

PPP - This was not applicable to our particular situation/business so we were unable to apply.- EIDL - We were awarded $1k in 'potentially forgivable' support (originally it was a loan meaning that it drove our business into debt). Of that money, we would then owe $332 taxes, be able to use $418 for payroll, and the remaining $250 could be applied to other overhead expenses (think utilities, etc).

- CARES Act - Oregon was the last state in the union to pay theirs out to citizens. Even though they received these funds from the Federal government at the same time as all of the other states, the Governor opted to hold the funds throughout the year and finally released funding in late November 2020.

- None of this money was given for the independent contractor claim that James had filed. For those who did qualify, these payments began coming as early as 11/20. However, the reality for so many was that was too late. In our example, we gave notice to our clients on 11/14 that we would close our doors forever in Oregon on 12/31. How many others weren't able to hold on as long as we were?

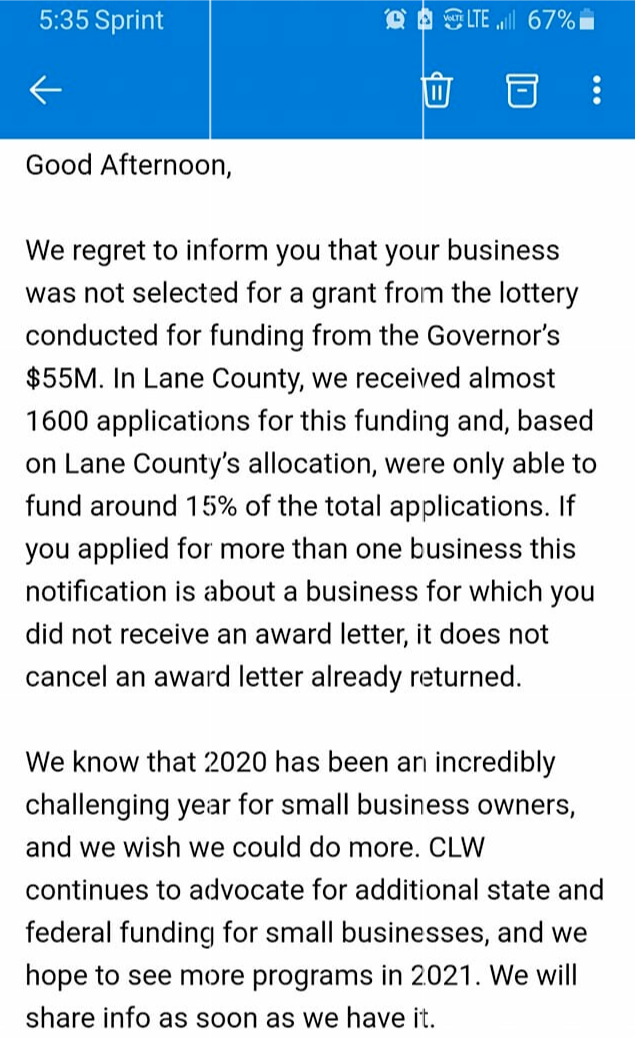

- Benton Country where our business operated offered two grant options from the total $55M in state-level funding. These funds if awarded would act as non-repayment, taxable income. In the end, they funded only 25% of those over 300 businesses who applied (image right).

Just the Beginning

Thank you for enduring through this long but valuable post. There is a lot of information that I want people to know. These are stories not being told, but rather simply glossed over in the mainstream in wide sweeping generalizations. So thank you for being an advocate for small businesses in your community. As you know from my Shop Indie Local blog post, I am a passionate advocate for entrepreneurs and small businesses!

Information courtesy of Echo Alexzander

2 Comments